The lion’s share of the liquidations took place on Binance, while Bitfinex saw the least. This suggests that the former might have the biggest share of amateur investors, according to Bitfinex principal modern technology officer Paolo Ardoino.

” Bitfinex has almost 1B in open interest but extremely reduced liquidation rate contrasted to competition,” discussed Ardoino.

” Finex seems to have traders that make use of utilize slightly a lot more very carefully.”

Variables behind the short-term cost decline

Bitcoin was relatively resistant compared with the rest of the market during the adjustment. Mainly, large-cap altcoins as well as decentralized financing symbols saw the greatest losses, such as Cosmos’ ATOM and also SushiSwap’s SUSHI visiting over 20% in a single day.

The marketplace likely dealt with as a result of the altcoin futures market being exceptionally overheated for a long term duration.

In recent weeks, lots of altcoins on systems like Binance Futures saw financing rates increase to around 0.3% to 0.7%. This is 30 to 70 times higher than the average 0.01%.

This is most likely the factor behind Bitcoin’s fairly tiny decline of around 7% compared to the 20% to 30% adjustments in the altcoin market.

Unlike Bitcoin, Ether showed short-term weakness also as Bitcoin was rallying to a new all-time high, as Cointelegraph reported.

For this reason, when BTC started to fall, Ether saw a much larger loss compared with Bitcoin, dropping by 9% in the very same duration.

Throughout February, specifically when the ETH/BTC set was showing stamina, Ethereum Fee saw a smaller sized pullback compared to Bitcoin as it got in price exploration. The weak point of ETH versus Bitcoin has actually had an adverse influence on the altcoin market in the last 24 hr.

Why a healing is likely

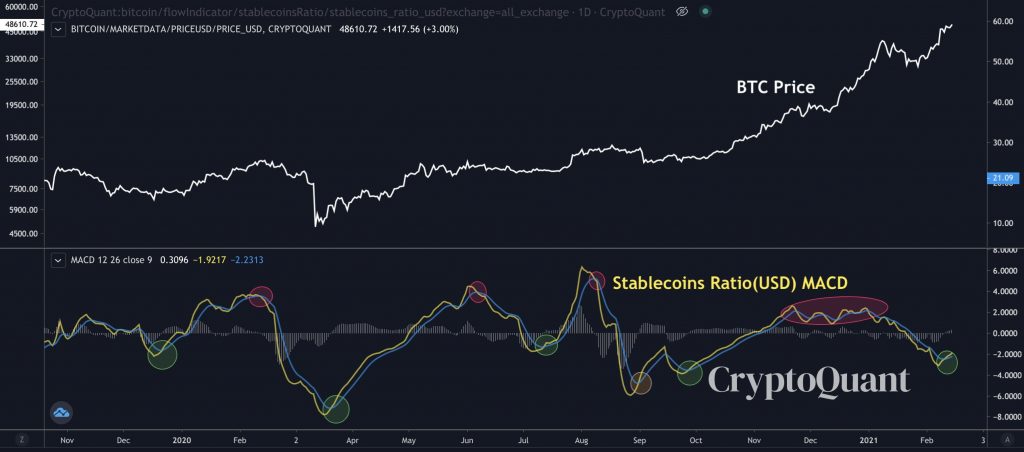

According to Ki Young Ju, Chief Executive Officer of CryptoQuant, there suffice stablecoin books in the cryptocurrency exchange market to activate one more boost for Bitcoin.

In the crypto market, sidelined funding is often stored in stablecoins as opposed to cash money or in checking account because they are a lot easier and faster to deploy on exchanges. Ju said that it is an ideal time to get Bitcoin, given that a newfound rally is more probable. He created:

” If you’re a lasting financier, now is the time to purchase $BTC. Not sure the amount of adjustments would be along the road, but the on-chain indication states there are enough stablecoins in exchanges contrasted to Bitcoins to get one more upper hand.”

Along with favorable principles, altcoins have actually started to recover swiftly after a capitulation-like modification.

Following the strong relief rally of altcoins, Bitcoin and also Ether followed suit, recuperating to $48,000 and $1,800, specifically.

The combination of the swift healing of large-cap altcoins and also the wealth of stablecoins on exchanges increases the likelihood of the BTC rally to proceed.